Book A Tour

Enrol Now

Join Our Team

KingKids FAQs

KingKids FAQs

We know you might have some questions, so we’ve outlined many of the key questions other families have asked in the past. Take a look through our KingKids FAQs below and they should help you with the information you need to know as a parent or guardian enrolling your child into one of our KingKids Childcare Centres. For any additional queries, please don’t hesitate to contact our Centres directly.

What do we need to bring?

- A clean change of clothes; underwear, socks, and jacket (clearly labelled)

- A bag large enough to hold all your child’s belongings

- Shoes that cover the foot – no open toe shoes please

- Appropriate clothing that is consistent with our sun smart policy. No singlets are to be worn.

- Lockers are provided for your child’s bag to remain for the day. This will be labelled, and a photo of your child will help them recognise which one is theirs and provide a sense of belonging.

- The KingKids Wet Bag that your child received on enrolment

- Nappy rash cream

- Action plan for Allergies/Medical conditions

- Medication (A medication form must be completed for this to be administered)

- Child’s comfort items (blanket, teddy)

Click here for more information on your first day at childcare.

What are your opening hours?

Our Berwick, Hallam, Narre Warren and Rowville Centres are open Monday to Friday from 6.30am to 6.30pm, while our KingKids Bentleigh Centre is open from 7.00am to 6:30pm. All our centres operate 52 weeks a year, closing only on Public Holidays and if mandated by the government due to serious conditions such as a code red fire threat.

What is provided?

Activities, education and care for your child that will keep them entertained and stimulated.

All your child’s meals (breakfast, morning tea, lunch, afternoon tea and a late snack). Children up to 12 months of age are provided with formula at no cost to you (each centre only holds one formula brand, so check with your centre as to the brand they have). If you choose to give your child another brand of formula, please provide this to your child’s Educators. We’re happy to give your child breast milk in accordance with our breastfeeding policy.

Nappies are provided as required. The Centre has a chosen brand. If you would prefer another brand to the one provided, please send additional nappies in your child’s bag and inform their Educator. If your child requires nappy cream, please provide this in its original packaging clearly labelled to leave at the centre. You can give this to your child’s Educator.

We apply our chosen brand of sunscreen to children 20 minutes before going outside on days of UV index rating of 3+ as per SunSmart Policy. If your child has a specific brand of sunscreen that they prefer, please provide this to our Educators.

At KingKids we support children’s rest and relaxation needs and supply all children’s bedding and cushions which is laundered at our Centre as required.

Where can I see learning updates?

Families will access their Child/rens profile by downloading ‘Xplor home’ and creating an account.

How do I create an account?

- Xplor will send you a welcome email upon enrolment

- Follow the prompts and set a password for your account

- Login to https://home.myxplor.com/with your email and password.

- Click ‘Merge Profile’. (This is applicable even if it is your first Xplor account)

- Enter preferred email address

- Check your email and authorise ‘set up’

Follow login prompts and press ‘Finish’

What can I see on the App?

- Childs observations

- Weekly highlights

- Pictures of your child’s day

- Nappy Change/Toiletings times

- What your child ate for lunch

- Meal times and servings

- Sleep and rest times

Download the app from your phone

- Open the ‘App Store’ app on your iOS device.

- Tap ‘Search’.

- In the search bar, begin typing ‘Storypark’.

- Select ‘Storypark for Families’ in the search results.

- When the app displays, tap ‘Free’.

- Tap ‘Install’.

- Enter your Apple ID password if prompted.

- When the app has finished downloading, tap ‘Open’.

- If you have never used Storypark before, download and open the ‘Storypark for Families’ app. Find it here on iOS and here on Android.

- Tap ‘Create an account’ button.

- Add a photo of yourself so your family can see it’s you when you post moments and responses.

- Fill in the form with your name, email and password.

- Tap ‘Next’.

- Then you will be asked to add your children by filling in their name, photo and birthday.

- Tap ‘Next’ and you’re done. Now you can start adding moments to your child’s profile!

What does the Welcome Pack include?

- KingKids t-shirt

- KingKids hat (to stay in your child’s room for use at the centre)

- Personalised labels

- Wet/Dry bag

- Balloons

- KingKids drink bottle

- KingKids pen

- KingKids backpack

Are all meals cooked on the premises?

Yes, all meals are cooked on the premise. We ensure they meet Nutrition Australia standards by using FEED Australia to finalise our seasonal menu’s. Children and Families are encouraged to participate in the creation of our menus to ensure we capture a wide range of cuisines.

We provide alternative meals each day to cater to any Allergy and Dietary requirements. This includes vegetarian meals, Halal products, dairy free, and many other adjustments. Please let our team know of any Dietary requirements upon enrolment or update us as they become apparent.

What are authorised nominees?

An Authorised nominee is a person who has been given permission by a parent or family member to collect your child from the Service. This person can also give consent for medical treatment or the administration of medication for your child.

It is important that you provide the Authorised Nominee’s name, address, and contact details. We recommend that you include as many Additional Contacts as possible, so if you get stuck you can call on these people to help out. It is recommended that you always carry photo ID with you, if the person collecting the child is unknown to the Educators, they may be asked to provide this.

Do you offer shorter days?

We offer both 10 and 12-hour days at our Centres, this is so families can utilise their allocated CCS hours more efficiently.

What is a CWA and why do I need to sign one?

A Complying Written Arrangement (CWA) is an ongoing agreement between an Early Childhood Education Centre service provider and a Parent/Guardian, to provide care in return for fees. The CWA must contain a minimum amount of information as defined by the Government.

We are required to have a CWA in place for each child in their care, as set out in subsection 200B (3) of the Family Assistance Administration Act.

The CWA needs to include all the following (in accordance with subsection 200B (3) of the Family Assistance Administration Act):

The names and contact details of the parties to the arrangement

The date the arrangement was entered into

The name and date of birth of the child to whom sessions of care are proposed to be provided

Whether care will be provided on a routine basis under the arrangement, and if so: – details about the days on which sessions of care will usually be provided; and – usual start and end times for these sessions of care

Whether care may be provided on a casual or flexible basis under the arrangement (either in addition to, or instead of, being provided on a routine basis)

Details about fees proposed to be charged to the individual for the sessions of care provided under the arrangement, which can be detailed by reference to other material (such as a fee schedule or information available on a website maintained by the provider) that the parties expressly understand may vary from time to time.

A CWA is required for all families that are attending KingKids. The CWA Agreement must be signed before a child can commence are at one of our services.

For more information, please go to the following website: https://www.humanservices.gov.au/individuals/services/centrelink/child-care-subsidy

Any time your child’s booking changes you will be required to sign a new agreement.

Can I have more than two days orientation?

Most families find that two orientations are enough for their children to feel comfortable in our service, however if you and your child want more than two orientations, then that is absolutely fine. It is important that both you and your child feel comfortable, and we will do what we can to make this possible.

What happens if my child is sick?

We follow the minimum exclusion period as advised in “Staying Healthy in Childcare”

What is the CCS?

On the 2nd of July 2018, the Child Care Subsidy (CCS) system came in to affect. Childcare Subsidy is designed to provide more assistance to low and middle-income families.

Many families out of pocket cost Child Care fees have fallen between $20 – $30 per day under the CCS system.

Who is eligible?

Some basic requirements must be satisfied for an individual to be eligible to receive Child Care Subsidy for a child. These include:

The child/ren must 13 years old or younger and not attending high school (some exceptions do apply)

All children must be up to date with their immunisations. You will be required to provide a copy of the statement to the service at least every six months.

Residency requirements must be met

The child/ren must be attending an approved Child Care Service.

If your child is absent from childcare?

We pay this subsidy for up to 42 absences for each child, per financial year. You can use these absence days for any reason, including if the child is overseas. We don’t need evidence.

Absence days are the days you would normally get CCS. This includes public holidays. You can only use an absence day after your child has physically attended the service for the first time.

In special circumstances, you may get CCS for more than 42 absence days. Talk to your childcare service about this. You may need to provide supporting documents.

We’ll cancel your enrolment if either of the following occurs:

your child hasn’t attended childcare for 8 continuous weeks

your childcare service advises us that your child is no longer attending.

For more information on the absences, please visit the human services website

Additional Child Care Subsidy

If you’re eligible for Child Care Subsidy you may be able to get extra help with the cost of approved childcare.

To get this you must be eligible for Child Care Subsidy. And you need to be 1 of the following:

an eligible grandparent getting an income support payment

transitioning from certain income support payments to work

experiencing temporary financial hardship.

For more information on the ACCS, please see the following page on the Human Services website

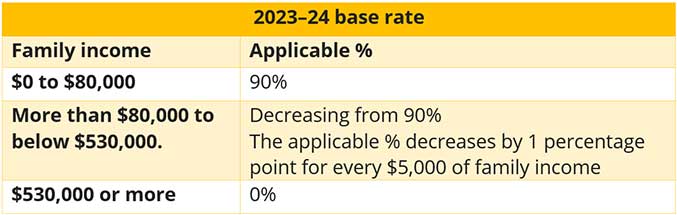

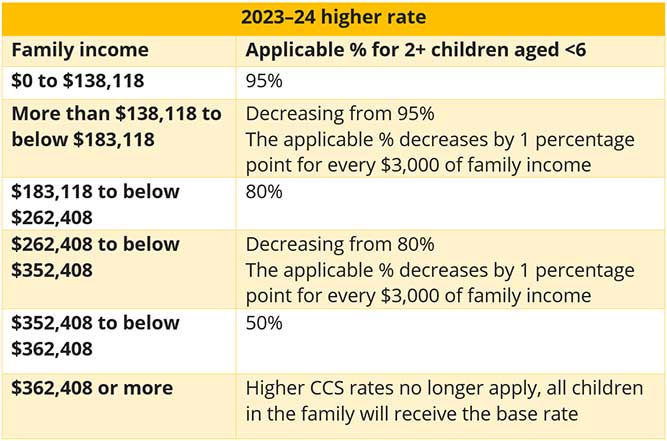

Child Care Subsidy Entitlement

There are three factors that determine a family’s level of Child Care Subsidy. These include the Combined Family Income, the Activity Test and the Type of Care that you are applying for such as long day care or family day care.

The Combined Family Income

The Activity Test

The number of hours of subsidised childcare that families have access to per fortnight is determined by a three-step activity test.

In two parent families both parents, unless exempt, must meet the activity test. In the case where both parents meet different steps of the activity test, the parent with the lowest entitlement determines the hours of subsidised care for the child.

Recognised activities

A broad range of activities meet the activity test requirements, including:

- Paid work, including being self-employed or on leave (including paid or unpaid parental leave)

- Doing unpaid work in the family business

- Training courses for the purpose of improving the individual’s work skills or employment prospects

- An approved course of education or study

- Volunteering

- Unpaid work experience or internships

- Actively setting up a business

- Actively looking for work Recognised activities can be combined to determine the maximum number of hours of subsidy.

- Time taken to travel between the childcare service and the parents/carers place of work, training, study, or other recognised activity can also be included.

- Activity hours do not need to coincide with childcare hours. For example, an individual undertaking work on the weekends is entitled to Child Care Subsidy during the week.

- Low-income families with a combined annual income of $68,163 or less who do not meet and are not exempt from the activity test are entitled to 24 hours of subsided care per fortnight under the Child Care Safety Net.

The Service Type

The Child Care Subsidy (CCS) cap amount that will be applied to your account will be determined by the Service Type your child attends.

There is a different rate for Long Day care Centres and Family Day Care. These caps place an upper limit on the amount of Child Care Subsidy the Australian Government will provide. The rate cap will be used, in combination with family’s income and level of activity to calculate the amount of subsidy a family is entitled to receive.

Where a childcare service charges less than the hourly cap, families will receive their applicable percentage of the actual fee charged. Where a service charges more than the relevant cap, families will receive their applicable percentage of the hourly rate cap.

Exemptions

There are exemptions to the activity test for individuals who legitimately cannot meet the activity test requirements, such as parents with disability and carers.

Families who do not meet and are not exempt from the activity test and have a preschool aged child who attends preschool at a centre-based day care service may be entitled to 36 hours of subsidised care per fortnight. This only applies to the preschool aged child/ren in the family.

To receive this entitlement, the child needs to be in the year two years before grade one of school (based on information provided in the family’s claim) and attending an appropriate preschool program at a centre-based day care service (as reported by the family’s childcare service).

Child Care Changes

Childcare Subsidy Changes – families are responsible for their accounts with Centrelink.

Report a change in circumstances

You need to tell Centrelink if your circumstances change when you’re getting Child Care Subsidy.

Keep in mind, if the changes impact your subsidy, it can take up to 2 weeks to apply. This is because Centrelink check your eligibility and pay Child Care Subsidy fortnightly.

You can update most changes using your Centrelink online account through myGov or the Express Plus Centrelink mobile app.

If you don’t tell Centrelink about changes to your circumstances within 14 days, it may affect your subsidy. You may be overpaid you and you’ll have to pay the money back.

If your childcare hours change you should review your family income estimate and activity levels. You can do this at any time using your Centrelink online account through myGov. Use the online guides to help you update your:

- estimate

- activity test.

For more info on changes of your CCS, please visit the Human Services website.

How do the fees work? How do I calculate my out-of-pocket costs?

To determine your actual out of pocket costs you’ll need to know the following:

- Your combined family income &

- How many hours that you meet of the activity test

- The Centre’s daily rate

This information can then be inputted into the calculator on our CCS page to determine your out-of-pocket cost: https://kingkids.com.au/child-care-subsidy/

What days are the Direct Debits processed?

Direct debits are process on Thursdays.

What bond needs to be paid?

Bond

Each family is required to pay a $150 Bond payment. This is refundable when your child leaves the service unless monies are owed, in which case they will be deducted from the Bond.

Enrolment Fee

To secure your child’s position at our centres, a ‘non-refundable’ $60 enrolment fee is required to be paid before orientation starts . Once paid, the families receive a KingKids Welcome Pack.

What happens if we want to go on holidays?

We allow for four (4) weeks holiday discount per calendar year (Jan-Dec) at 50% your ‘normal Daily fee’. Your ‘normal Daily fee’ is your normal booking from Monday to Friday, not for example Thursday to Wednesday.

This is included in your annual absences allowance as mentioned above under CCS absence information.

We require two (2) weeks’ notice for the holiday rate to apply. Unused holidays do not accumulate or roll over into the next year. The holiday rate will not be applied if your account is more than two weeks in arrears.

What does the 42 Absence Days mean for me?

Do holiday rate days get counted as absent days?

Yes, holidays do count as absent days.

What about public holidays?

Like most employees, our Educators are paid a wage on Public Holidays. Therefore, full fees are still payable on Public Holidays for all permanent bookings.

When can I enrol my child into Kindergarten?

3-Year-Old Kindergarten:

At KingKids our 3-year-old kinder programs are led by Bachelor qualified Educators. Funded 3-year-old Kindergarten is being introduced in stages. In 2023, five – fifteen hours per week of subsidised kindergarten will be available across Victoria. As of 2023, you can access up to the full 15 hours of funded kindergarten.

4-Year-Old Kindergarten:

All children in Victoria are eligible to access a kindergarten program in their year before primary school. To enrol in a kindergarten program, your child needs to be at least four years old by 30 April in the year they will attend the program.

Your child must be enrolled in school by the age of six unless they have an exemption. So, if your child’s birthday falls before 30 April in the calendar year, you have a choice about whether to enrol your child in school in the year they turn five or the next year. Children learn at different rates, in different ways, and at different times. In some cases, your child may benefit from starting a kindergarten program later.

What is the process when we leave the Centre?

We require two (2) weeks written notice when your child is leaving us. If your child does not attend their final two weeks, full fees are still required. The bond that you paid on enrolment can either be paid back into your nominated account or used to pay (or part pay) your final account.

Do you offer discounts for multiple children attending from one family?

No, unfortunately we are not able to offer discounts for multiple children attending the service as our centres operate at 100 percent capacity. We do however work within the parameters of the Childcare subsidy which offers a greater subsidy for children with siblings enrolled.

How many children are each Educator responsible for? Ratios

The following ratios will be implemented at KingKids Early Learning Centres and Kindergartens at all times. These ratios are considered to be a minimum standard and due consideration and risk assessment will occur to ensure correct Educator levels are in operation.

Educator to child ratios:

Children under 36 months, 1 Educator to 4 children

Children over 36 months, 1 Educator to 11 children

1 Educator to 8 children on excursion (minimum requirement)

KingKids has the goal of maintaining a ratio of 1 Educator to 9 children (over 36 months) whenever possible.

Do we offer Incursions and Programs at the centre?

Incursions

Yes, we offer enjoyable incursions at our centres, these include farm visits, music, dance and language programs and visits from special guests such as Indigenous Community Members.

Ongoing Programs

Each Centre offers weekly external programs to enhance the learning opportunities for Children that forms part of our emergent curriculum.

These can include:

- Music and Movement

- Sports programs

- Soccer Programs

- Language Programs

Click here for more information on our incursions.

Do we offer Excursions at the centre? Bush Kinder & Community Outing Program

Community Outing Program

Yes, we believe our ‘Community Outings Program’ will provide your child the opportunity to engage and explore in their local community. Outings can include visiting the local gardens or parks to collect materials and resources for art projects, walk to the local schools, local milk bar or supermarket to purchase items for a home cooked meal as prepared by our children.

We will set out on community outings and excursions using a walking school bus (walking to our destination) or our KingKids community outing bus.

These excursions will be spontaneous and may occur at any time during the hours outlined on your annual permission form – weather permitting. We will also continue to share our learning activities via photos and videos on Xplor/StoryPark, so you can follow all our adventures.

Bush Kinder

Is an outdoor excursion that provides greater learning opportunities for our children enrolled in our Kindergarten curriculum.

We believe the introduction of ‘Bush Kinder’ will provide your child the opportunity to visit the local parks / gardens to collect materials and resources for art projects, walk to the local schools to participate in educational programs such as PMP(Perceptual Motor Program) or theatrical demonstrations.

Click here for more information on our excursions.

What qualifications do the Educators hold? First Aid, CPR, Child Safety, Professional development Courses?

KingKids Educators who are actively working alongside children and part of the Educator: children ratio will have completed a minimum of a certificate III level qualification.

All Educators prior to commencement of employment at KingKids are required to provide:

- Current Police Check

- Employee working with Children Check

- First Aid certification

- CPR certificate

- Anaphylaxis and Asthma training

- Child Safety Course Certification

These remain up to date at all times. Catering staff also ensure that their food handling qualifications are up to date at all times.

We believe professional development is a necessary process for Educators to engage as a part of their continued development and to always strive to exceed the National Quality Standards of the broader framework of KingKids. It aims to reflect current and projected needs of both KingKids and the individual team member, providing support for career development and adapting to change and changing roles.

How often are your services cleaned?

At KingKids we have embedded health and hygiene practices throughout the day. We have also employed professional cleaners to attend our services to ensure a safe and clean environment.

What is the process of children transitioning to School from Kindergarten?

If your child is moving from kindergarten to school, their educator will write a transition and learning statement.

The statement includes:

- your child’s name, date of birth and photo

- their interests, skills, and abilities

- strategies to teach your child

- your contact details and the details of any other professionals who are supporting your child.

Your kindergarten will give the statement to your child’s school or prep teacher. It helps the teacher get to know your child and plan the best way to teach them.

For more information on the transition from kinder to school, please see the following link: https://www.vic.gov.au/transition-school-resources-families

Click here for more information.

How do I enroll into KingKids?

At KingKids we use an online enrolment system called QKenrol, and this enrolment form can be completed in the comfort of your own home.

Our team are always happy to help you with the enrolment process if you do find yourself needing assistance.

What will I need to enroll into KingKids?

- Immunisation statement for child/ren (Download from Mygov)

- Individual CRN number for Child/ren and primary carer

- A minimum of 3 emergency/additional contacts

- Family Doctor information

Start Enrolment

Go to our website: www.kingkids.com.au

Click on the ‘ENROL’ button. This will then take you to an external page

If you are a current family, log in with your family lounge details

If you are a new family to KingKids, press on the ‘REGISTER’ button.

Current Families:

‘Log in’ with current family lounge details

You will then be taken to an external page that looks like this:

- Click on the ‘EDIT’ button under the child section & complete enrolment accordingly. This must be done before commencement date. If more than one child is being enrolled, each child must be edited individually.

- Press the ‘SUBMIT’ button which is on the left of the screen (bottom of screen in iPad), NOT the ‘SAVE’ button

- Once you save the edits, a notification will come through to the service notifying of any changes made

If you have a new booking request, you can make this through the booking request section:

- Click on the ‘NEW REQUEST’ button & follow the prompts:

Long Day Care/Kindergarten/Preschool. - Select the service in which you want to request the booking for (Bentleigh/Berwick/Hallam/Narre Warren/Rowville). Fill out according to your needs.

- Add any comments made that we must be aware of regarding your request

Press ‘SAVE’ - A confirmation letter of the request will be sent to your email

The service will then either accept your offer or send you a counteroffer, depending on services availabilities at the time

Once offer is accepted by service, you will receive an email with a ‘Letter of Offer’

New Families:

- Click on the ‘REGISTER’ button. Enter your details accordingly.

- You will then get an email to complete registration & set a password

- Once registration is complete, press the ‘SIGN IN’ button & sign in with your details. This will be your family lounge log in also.

- You will then have to edit your personal details

- Once completed, you will then get to this screen

You will then have to submit a request for bookings.

- Press on the ‘NEW REQUEST’ button under the booking request section

Then follow the prompts:

Long Day Care/Kindergarten/Preschool - Select the service in which you want to request the booking for (Bentleigh/Berwick/Hallam/Narre Warren/Rowville)

Fill out according to your needs. - Fill in any comments that we must be aware of, in regard to your request

- Press ‘SAVE’

- A confirmation letter of the request will be sent to your email

- The service will then either accept your offer or send you a counteroffer, depending on services availabilities at the time

- Once offer is accepted by service, you will receive an email with a ‘Letter of Offer’

- Click on the link provided, then edit your child/ren’s details

- Click on the ‘EDIT’ button under the child section & complete enrolment accordingly. This must be done before commencement date. If more than one child, each child must be edited individually

- Press the ‘SUBMIT’ button which is on the left of the screen (bottom of screen on an iPad), NOT the ‘SAVE’ button.

- The service will then contact you to organise orientations & payment of security deposit plus bond which will have been discussed on initial tour of the service

Looking For A Childcare Centre?

Get in Touch By Phone Or Email

Please contact your closest centre using the details below:

Bentleigh

Phone: (03) 7068 7866

Email: Bentleigh@kingkids.com.au

Berwick

Phone:(03) 7068 7866

Email: berwick@kingkids.com.au

Dandenong

Phone: (03) 7076 1570

Email: dandenong@kingkids.com.au

Hallam

Located in service lane, driveway before Coles service station

Phone: (03) 9999 7930

Email: hallam@kingkids.com.au

Narre Warren

Phone: (03) 9796 6843

Email: narrewarren@kingkids.com.au

Rowville

Enter via Stud Road, next to La Porchetta

Phone: (03) 8738 8770

Email: rowville@kingkids.com.au