Book A Tour

Enrol Now

Join Our Team

Childcare Subsidy

Child Care Subsidy Changes

The federal government’s planned changes to the childcare subsidy were introduced on 10 July 2023, bringing much needed relief to managing the family budget. These changes included:

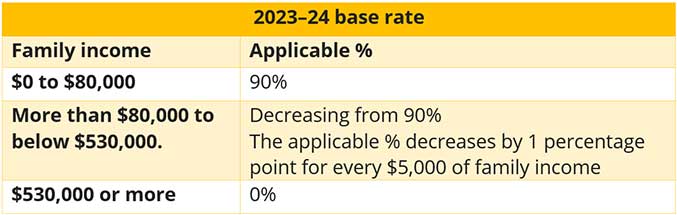

- The maximum percentage of CCS is increased from 85% to 90%.

- Families earning $80,000 or less will get 90% childcare subsidy.

- Families earning over $80,000 and under $530,000 will get a subsidy that tapers down from 90%, depending on their income.

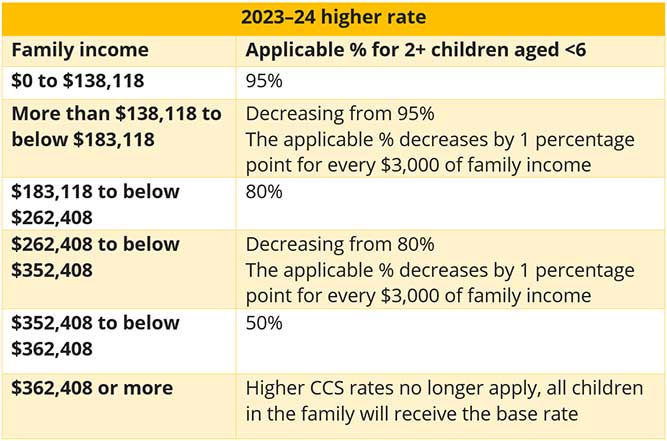

- Families with more than one child aged 5 or under in care can get a higher rate for their second and younger children.

- The subsidy decreases 1% for each $5,000 earned.

- Aboriginal and/or Torres Strait Islander children can get at least 36 subsidised hours of early childhood education and care per fortnight, regardless of their family’s activity level.

At KingKids we understand these changes can sometimes be confusing. Our team welcomes all enquiries and are well informed to answer your questions. If you’d like to discuss the recent childcare subsidy changes, have a chat with the team at your KingKids Centre.

Current Child Care Subsidy Entitlement

There are three factors that determine a family’s level of Child Care Subsidy. These include the Combined Family Income, the Activity Test and the Type of Care that you are applying for such as long day care or family day care.

1. Combined Family Income

2. The Activity Test

Your activity level is based on the hours of recognised activities you do. Your activity level is used to work out how many hours of subsidised childcare you can get each fortnight. If you have a partner, both of your activity levels will be included. The lower of your or your partner’s activity level will be used to work out your hours of subsidised care. The hours of subsidised child care you can access per fortnight applies to each child.

There are 4 activity levels.

You can access up to 36 hours of subsidised childcare per fortnight if your only activity is either:

- volunteering

- actively looking for work.

To access this amount, you must spend a minimum of 8 hours each fortnight doing the activity.

From 10 July 2023, If you have an Aboriginal and/or Torres Strait Islander child, families can get at least 36 hours of subsidised care per fortnight for each Aboriginal and/or Torres Strait Islander child in their care and attending child care. Families may get more than 36 hours of subsidy per fortnight based on their circumstances and the amount of recognised activity they do. If you would like to get at least 36 hours of subsidised care, you should contact Services Australia to update your child’s CCS details. It’s voluntary for you to tell Services Australia this. For more information go to Services Australia.

Recognised Activities

Families need to do a recognised activity to get Child Care Subsidy.

Recognised activities can include any of the following:

- paid work including being self employed

- paid or unpaid leave, including -paid or unpaid parental or maternity leave

- unpaid work in a family business

- unpaid work experience or unpaid internship

- actively setting up a business.

They can also include any of these:

- doing an approved course of education or study

- doing training to improve work skills or employment prospects

- actively looking for work

- volunteering

- other activities on a case-by-case basis.

Services Australia will only recognise some of these activities for a certain amount of time.

For example:

- periods of unpaid leave for up to 6 months, this doesn’t apply to unpaid parental leave.

- setting up a business for 6 months out of every 12 months.

If you’re setting up a business and then start working in the business, you need to update your activity details. You need to update your activity from setting up a business to paid work.

Parental or maternity leave

Services Australia will count any paid or unpaid parental and maternity leave you take. This will continue to count this as long as you’re expected to return to work after your leave ends. When including this as a recognised activity you should provide the hours you worked before you started your leave.

3. The Service Type

The Child Care Subsidy (CCS) cap amount that will be applied to your account will be determined by the service Type your child attends. There is a different rate for Long Day care Centres and Family Day Care. These caps place an upper limit on the amount of Child Care Subsidy the Australian Government will provide. The rate cap will be used, in combination with family’s income and level of activity to calculate the amount of subsidy a family is entitled to receive.

Where a child care service charges less than the hourly cap, families will receive their applicable percentage of the actual fee charged. Where a service charges more than the relevant cap, families will receive their applicable percentage of the hourly rate cap.

Exemptions

There are exemptions to the activity test for individuals who legitimately cannot meet the activity test requirements, such as parents with disability and carers.

Families who do not meet and are not exempt from the activity test and have a preschool aged child who attends preschool at a centre-based day care service may be entitled to 36 hours of subsidised care per fortnight. This only applies to the preschool aged child/ren in the family.

To receive this entitlement, the child needs to be enrolled and attending the program two (2) years before grade one (1) (based on information provided in the family’s claim) and attending an appropriate preschool program at a centre-based day care service (as reported by the family’s child care service).

Complying Written Agreement (CWA)

What is a Complying Written Arrangement (CWA)?

A Complying Written Arrangement (CWA) is an ongoing agreement between an Early Childhood Education Centre service provider and a Parent/Guardian, to provide care in return for fees. The CWA must contain a minimum amount of information as defined by the Government.

Service providers are required to have a CWA in place for each child in their care, as set out in subsection 200B (3) of the Family Assistance Administration Act.

The CWA needs to include all of the following (in accordance with subsection 200B (3) of the Family Assistance Administration Act):

- The names and contact details of the parties to the arrangement

- The date the arrangement was entered into

- The name and date of birth of the child to whom sessions of care are proposed to be provided

- Whether care will be provided on a routine basis under the arrangement, and if so:

- details about the days on which sessions of care will usually be provided; and

- usual start and end times for these sessions of care

- Whether care may be provided on a casual or flexible basis under the arrangement (either in addition to, or instead of, being provided on a routine basis)

- Details about fees proposed to be charged to the individual for the sessions of care provided under the arrangement, which can be detailed by reference to other material (such as a fee schedule or information available on a website maintained by the provider) that the parties expressly understand may vary from time to time

Who needs a CWA?

A CWA is required for all families that are attending KingKids. The CWA Agreement must be signed before a child can commence care at one of our services and must be re-signed with any changes to permanent bookings.

For more information please go to the Childcare Alliance website.

Child Care Subsidy Net Fee Calculator

Looking For A Childcare Centre?

Get in Touch By Phone Or Email

Please contact your closest centre using the details below:

Phone: (03) 7068 7866

Email: bentleigh@kingkids.com.au

Phone: (03) 8786 7866

Email: berwick@kingkids.com.au

Located in service lane, driveway before Coles service station

Phone: (03) 9999 7930

Email: hallam@kingkids.com.au

Narre Warren

Phone: (03) 9796 6843

Email: narrewarren@kingkids.com.au

Rowville

Enter via Stud Road, next to La Porchetta

Phone: (03) 8738 8770

Email: rowville@kingkids.com.au